All Categories

Featured

Table of Contents

Insurer will not pay a minor. Rather, consider leaving the money to an estate or trust fund. For even more comprehensive info on life insurance coverage get a duplicate of the NAIC Life Insurance Coverage Purchasers Overview.

The internal revenue service positions a limitation on just how much cash can enter into life insurance costs for the plan and just how swiftly such premiums can be paid in order for the plan to keep every one of its tax benefits. If specific restrictions are gone beyond, a MEC results. MEC insurance policy holders may undergo tax obligations on distributions on an income-first basis, that is, to the degree there is gain in their plans, as well as fines on any kind of taxable quantity if they are not age 59 1/2 or older.

Please note that superior loans build up passion. Income tax-free therapy likewise thinks the lending will become pleased from earnings tax-free survivor benefit profits. Financings and withdrawals decrease the plan's cash value and survivor benefit, may trigger specific policy benefits or riders to come to be not available and may raise the chance the plan might gap.

A customer might certify for the life insurance coverage, however not the biker. A variable global life insurance coverage contract is a contract with the main function of supplying a fatality benefit.

What does Cash Value Plans cover?

These portfolios are carefully handled in order to satisfy stated financial investment purposes. There are costs and costs linked with variable life insurance contracts, including mortality and danger fees, a front-end load, administrative costs, investment monitoring fees, surrender fees and costs for optional cyclists. Equitable Financial and its associates do not give lawful or tax guidance.

Whether you're beginning a family members or marrying, individuals typically begin to think regarding life insurance policy when somebody else starts to depend on their capacity to make a revenue. And that's terrific, since that's precisely what the death advantage is for. Yet, as you learn much more regarding life insurance policy, you're likely to locate that numerous policies for example, whole life insurance policy have greater than simply a fatality advantage.

What are the benefits of entire life insurance? One of the most enticing advantages of acquiring an entire life insurance policy is this: As long as you pay your premiums, your fatality benefit will never ever run out.

Assume you do not need life insurance policy if you don't have youngsters? You may wish to believe once again. It may appear like an unneeded expenditure. However there are several benefits to having life insurance coverage, even if you're not supporting a family. Right here are 5 reasons that you need to acquire life insurance coverage.

What is Trust Planning?

Funeral expenses, interment prices and clinical bills can include up. Permanent life insurance is offered in numerous quantities, so you can select a death advantage that meets your needs.

Determine whether term or permanent life insurance policy is ideal for you. As your personal situations modification (i.e., marital relationship, birth of a youngster or work promotion), so will certainly your life insurance coverage requires.

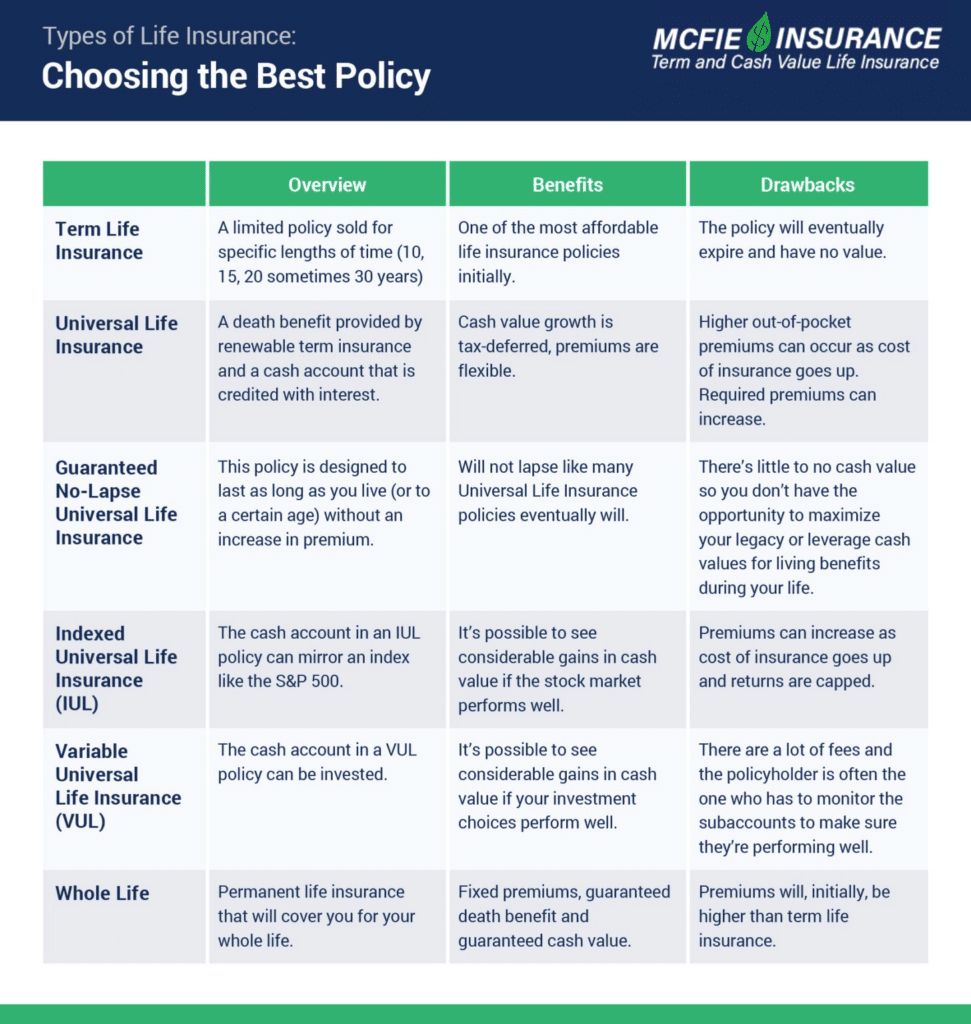

For the many part, there are two kinds of life insurance plans - either term or permanent plans or some mix of the two. Life insurance firms offer various forms of term plans and standard life policies along with "passion delicate" products which have become much more common given that the 1980's.

Term insurance offers defense for a specific time period. This period can be as short as one year or supply protection for a particular variety of years such as 5, 10, two decades or to a specified age such as 80 or sometimes as much as the earliest age in the life insurance policy mortality.

Who offers flexible Long Term Care plans?

Presently term insurance policy rates are very affordable and among the cheapest historically experienced. It ought to be noted that it is a commonly held idea that term insurance coverage is the least pricey pure life insurance policy protection available. One requires to review the plan terms carefully to make a decision which term life alternatives are appropriate to satisfy your certain situations.

With each brand-new term the costs is boosted. The right to renew the policy without proof of insurability is a crucial benefit to you. Or else, the danger you take is that your wellness may degrade and you might be not able to get a plan at the very same rates and even in all, leaving you and your recipients without coverage.

The size of the conversion duration will differ depending on the type of term plan acquired. The costs rate you pay on conversion is normally based on your "current achieved age", which is your age on the conversion day.

Under a degree term policy the face amount of the policy remains the very same for the whole period. With reducing term the face amount decreases over the period. The premium remains the very same yearly. Typically such plans are offered as home loan protection with the quantity of insurance coverage decreasing as the equilibrium of the mortgage reduces.

Who are the cheapest Cash Value Plans providers?

Typically, insurance firms have not can change premiums after the policy is marketed. Given that such plans might continue for years, insurance companies need to utilize conventional mortality, rate of interest and expense rate price quotes in the costs calculation. Flexible premium insurance coverage, nonetheless, permits insurance firms to supply insurance policy at reduced "existing" costs based upon much less conservative presumptions with the right to transform these premiums in the future.

While term insurance is developed to supply defense for a defined amount of time, long-term insurance policy is made to supply protection for your entire life time. To keep the premium price level, the premium at the younger ages surpasses the real price of security. This extra premium constructs a get (money value) which aids pay for the policy in later years as the expense of security surges above the costs.

The insurance business spends the excess premium bucks This kind of policy, which is often called money worth life insurance policy, creates a savings element. Cash money values are crucial to an irreversible life insurance coverage policy.

Latest Posts

Guaranteed Final Expense Insurance

Mortuary Insurance

Funeral Policy With No Waiting Period